Finance 103 for Small to Medium-Sized Business Owners:

Understanding Business Cash Flow – Part I

– David Tang

Have you ever heard a business owner say, “I don’t’ know where my cash has gone.” Well, he wouldn’t ask that question if he had a detailed cash flow statement. The purpose of this essay, and the one to follow in one week, is to explain the ‘ins and outs’ of business cash flow by breaking down and analyzing a cash flow statement.

A cash flow statement is a bridge between the income statement and the balance sheet. Almost all of the positioning of items on the balance sheet and the income statement considers the movement of cash. The best way to understand this is by looking at the cash flow statement. A cash flow statement has three separate components, as follows:

- Cash flow from operations,

- Cash flow from investing,

- Cash flow from financing.

This essay looks solely at the cash flow from operations piece, and the next essay will cover cash flow from investing and cash flow from financing. Also, at the end of the next essay, we will put all three components together to see a complete 5-year cash flow statement.

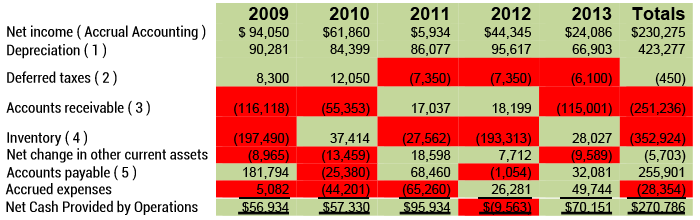

Here is a 5-year cash flow from operations schedule (Note: The numbers in red decrease cash flow and the numbers in green increase cash flow.):

Cash Flows from Operations

Here is a line-by-line analysis for most of the items shown in the schedule:

- Depreciation does not use up cash. Since it is an expense in the income statement, it is added back to net income in determining cash flow from operations.

- Deferred taxes, classified as an expense, do not use up cash. Since it is an expense in the income statement it is added back to net income in determining cash flow from operations. In this example, deferred taxes can be an expense or an income item (contra-expense) when deferred taxes are actually paid as was the case in 3 out of 5 years shown.

- In 3 out of 5 years shown here, accounts receivable has grown which means that some portion of sales revenue had been uncollected at those year-ends and that cash flow from operations is less by the uncollected revenue for those years. When accounts receivable declines in a given year, it is a source of cash.

- In 3 out of 5 years shown here, inventory has grown which means cash was used to increase inventory balances from the prior year and that cash flow from operations was used to increase inventory during the year.

- Accounts payable has grown over the 5 years shown here. This means that the company is borrowing from its vendors, which represents a source of cash to fund the business for several of the years in question.

“I certainly think you could look at the business side of how WWE was run, which was as a conservative company with little debt and strong cash balance.”

– Linda McMahon

In the above example, cash flow from operations was $40,000 greater than net income. The business was self-funding from an operations standpoint. Absent any large capital expenditures, the business is funding itself on a current basis and the company will have cash in the bank.

What is possible in a situation like this is that someone may be sitting on some bills from vendors that have not yet been entered into the accounting system. What would happen if that amount was $100,000? The results would depend on whether those bills were for: a) services or b) inventory. Would the net income and cash flow results be the same in either case? The answer is no and let me tell you why.

If the newly-found invoices are for services, net income would be lower by $100,000 but cash flow would remain the same. Why? Accounts payable would increase by $100,000 because the amount would be added back in determining cash flow. Therefore, there would be no effect on cash flow but net income would be lower by $100,000.

On the other hand, if the newly-found invoices are for inventory, there would be no effect on net income and no effect on cash flow. Also, under this scenario, the company would have a better looking balance sheet because retained earnings and working capital would be higher by $100,000. Clearly a better balance sheet would occur under this scenario. In either case, however, if I was the owner of this company I would not be happy learning that I had a $100,000 surprise that I wasn’t expecting. Also, depending on the credit terms I have with my bank, I could have violated my loan covenants (a whole separate discussion in and of itself).

“The value that some analysts put on revenue vs. what they put on profit is out of whack. If you can grow real cash earnings, that's 80% of what you ought to do and the revenue component is 20%.” – Lou Gerstner

This statement was made by Lou Gerstner many years ago. What I have seen over the past several years is a number of small- to medium-sized businesses do just that: increase cash earnings, sometimes while decreasing revenue. Sometimes they fired their worst customers, expanded their volumes with their best customers and found some new customers that made them more money. In other words, increased revenue doesn’t always equal increased profits and increased profits don’t always equal increased cash flow. Very few businesses can survive for any length of time without positive cash flow from operations.

In my next essay, we will explore how investment, loans and equity capital transactions influence cash flow.

And, there is more, there always is.

Be genuine.

Copyright 2014 © John J. Trakselis, Chicago CEO Coaching

Join the Discussion

What’s on your mind? What’s keeping you up at night? What are the thoughts from your desktop? If you have topics you’d like John to cover in this blog, please email john.trakselis@vistage.com or call (708)443-5518.